Northwoods Credit Union Sends Texts and Emails Now!

Is your information up to date?

Is your information up to date with us? Northwoods may send a text or email if fraud is suspected on your debit card. If we do not have your current cell phone number or email address, you could miss the alert, which could result in your card being blocked. If you are not sure we have the most current information for you, please call or stop in to update it.

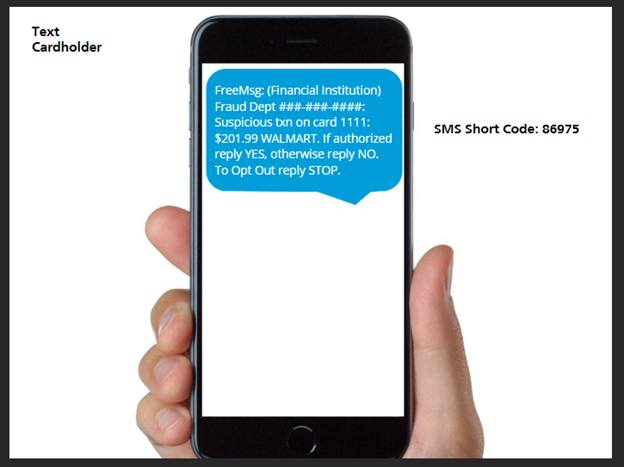

Getting the Alert

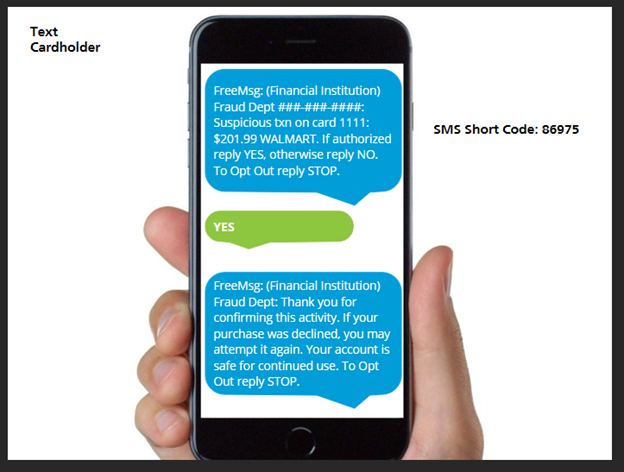

Fraud alert texts will come from a 5-digit number. Example: 86975*

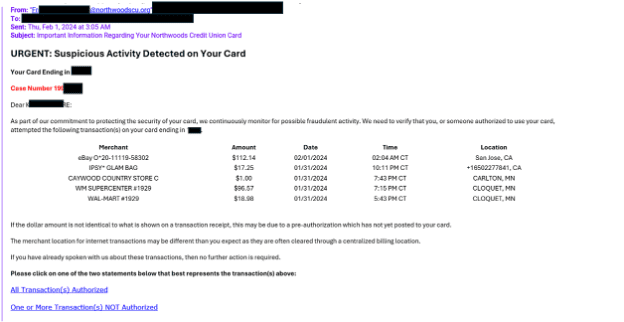

Fraud alert emails will come from an email with the Northwoods domain @northwoodscreditunion.org.

– Watch for typos and broken English on text messages or emails about your debit card as this could be a sign of fraud or phishing.

– Our fraud department will not ask for personal information through a text or email.

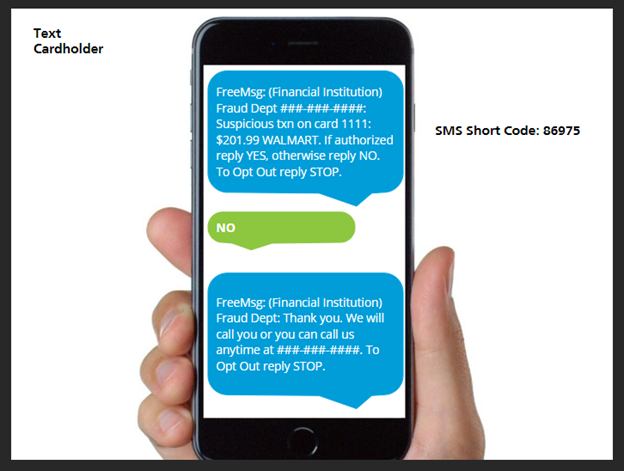

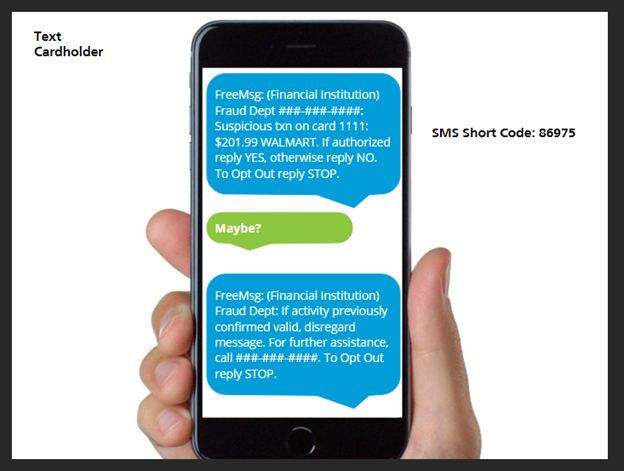

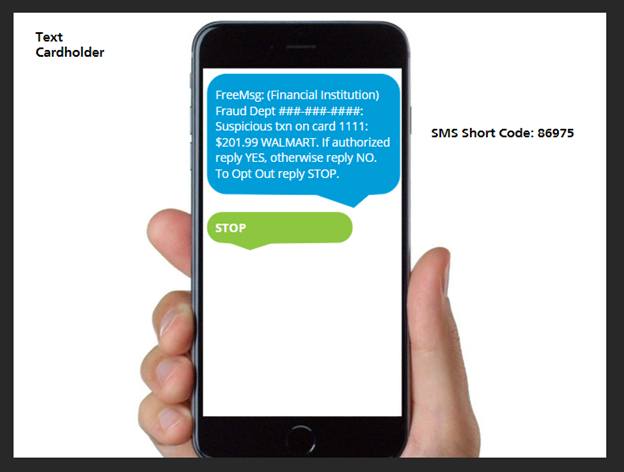

Please refer to the images below as legitimate fraud alert texts/email examples to look for.

Respond to the Alert

If you receive an alert, please respond to it, or contact Northwoods directly at 218-879-4181, in a timely manner. If you do not respond within a certain time frame, your card may be blocked even if the transaction was not fraudulent.

Suspicious about a text or email or phone call regarding your debit card or account with Northwoods? Do not respond, hang up and contact us directly.

We are always happy to help!

*Data carrier rates and fees may apply. Some links may take you to an outside website. We don’t control the content of outside sites. Please review their Privacy Policy as it may differ from ours. We hope you found the info you were looking for from Northwoods Credit Union. We do our best to provide helpful info but can’t guarantee the accuracy or completeness of the info presented in the article, under no circumstance does the info provided constitute legal advice. You are responsible for independently verifying the info if you intend to use it in any way. NCU is insured by NCUA.