Securing A Boat Loan in 2024: Your Comprehensive Guide

Ready To Purchase A New or Used Boat in Minnesota?

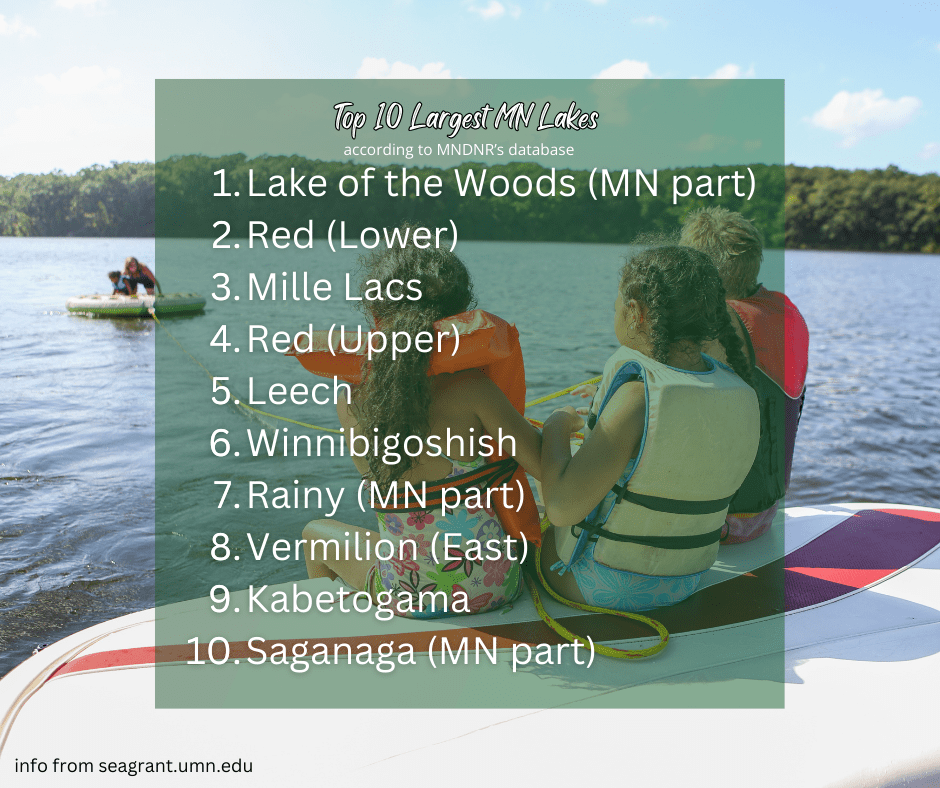

Whether you’re dreaming of cruising along serene, calm lake waters or angling for adventure and that next big fish at your favorite Minnesota lake, navigating the loan process efficiently is key. This guide helps unveil key strategies and considerations to help you set sail on your boat ownership journey with confidence.

Understanding Boat Financing Options

Embarking on your new or used boat ownership journey begins with understanding the diverse financing options available in 2024. From traditional loans to specialized marine lenders, explore the avenues that align with your financial goals and preferences.

Exploring Credit Union Loans

Traditional credit union loans remain a popular choice for securing boat loan financing. With competitive interest rates and flexible terms, credit unions offer stability and reliability in the lending landscape while giving you local, personal service.

Here at Northwoods Credit Union, we look at more than your credit score. Explore our recreational vehicle loans today!*

Factors Influencing Boat Loan Approval

Securing a boat loan in 2024 can hinge on various factors that influence loan approval and terms. From credit scores to debt-to-income ratios, understanding the metrics that lenders evaluate empowers borrowers to navigate the approval process effectively.

Creditworthiness and Score Analysis

Your credit score serves as a compass in the loan approval journey, guiding lenders or loan officers in assessing your financial situation and background. Explore the intricacies of creditworthiness and dive into actionable strategies for optimizing your credit score to secure favorable loan terms.

Your Credit Score: Maintaining a healthy credit profile helps demonstrate financial responsibility and enhances your eligibility for competitive loan terms on various loan types, like boat loans.

By understanding the factors that influence your credit score and implementing proactive measures, you can chart a course towards favorable loan approval and smooth sailing ahead.

Debt-to-Income Ratio Dynamics

The debt-to-income ratio emerges as a critical metric in the loan approval process, reflecting your ability to manage existing debt obligations in tandem with potential loan payments.

Navigate the waters of debt-to-income ratios to strike a balance that resonates with lenders and positions you as a favorable candidate for new or used boat financing.

What is a debt-to-income ratio? Learn more.

Ready To Apply For A Boat Loan in 2024: Your FAQs

Can I secure a boat loan with a less-than-perfect credit score?

Yes, securing a boat loan with a less-than-perfect credit score is possible. However, you may encounter higher interest rates or additional requirements to mitigate perceived lending risks.*

What documents do I need to apply for a boat loan?

Typically, lenders require documentation such as proof of income, identification, and details about the boat you intend to purchase.

Is a down payment required for a boat loan?

While down payment requirements vary among lenders, many boat loans do require a down payment that may range from 10% to 20% of the boat’s purchase price. It’s best to talk to your preferred financial institution representative. We can assist you today, locally in Cloquet, Moose Lake, and Floodwood surrounding areas.

Can I finance a used boat?

Yes, many lenders offer financing options for both new and used boats, allowing you to explore a wide range of vessels within your budget. Northwoods Credit Union can help finance your used boat today!*

Apply Today!How long does the boat loan approval process take?

The boat loan approval process duration varies based on factors such as the lender’s policies, your financial profile, and the complexity of the loan application.

Are there tax benefits associated with boat loans?

In certain specific cases, boat loans interest may be tax-deductible, offering potential tax benefits to qualified borrowers. Consult with a tax advisor for personalized guidance.

Boat Loans In 2024

Boat loans in 2024 entails navigating a dynamic financial landscape with confidence and clarity. By understanding the nuances of boat financing options, evaluating key factors influencing boat loan approval, and leveraging expert insights, you can embark on your boating journey with enthusiasm.

Always make sure to assess your personal financial situation first.

As you set sail towards your boating dreams, may favorable winds and smooth seas accompany your financial voyage!

We hope you found the info you were looking for from Northwoods Credit Union. We do our best to provide helpful info but can’t guarantee the accuracy or completeness of the info presented in the article, under no circumstance does the info provided constitute legal advice. You are responsible for independently verifying the info if you intend to use it in any way. Additionally, the content is not intended to be reflective of NCU’s products or services, for accurate and complete details about our product and service information, visit our product pages and talk with an NCU employee.