Are Credit Unions FDIC Insured? Understanding the Difference Between a Credit Union and a Bank

When it comes to choosing where to keep your money, it’s common to ask: Are credit unions FDIC insured? It’s also normal to wonder whether a credit union or bank is the better fit for your financial needs.

Let’s break it down simply and clearly.

Are Credit Unions FDIC Insured?

No, credit unions are not insured by the FDIC (Federal Deposit Insurance Corporation). The FDIC only insures deposits at banks. But that doesn’t mean your money isn’t safe at a credit union.

Instead, most credit unions are insured by the NCUA—the National Credit Union Administration. This is a federal agency, just like the FDIC, and it offers the same level of protection.

If your credit union is federally insured, the NCUA covers deposits up to $250,000 per member, per institution, per ownership category. This includes checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs).

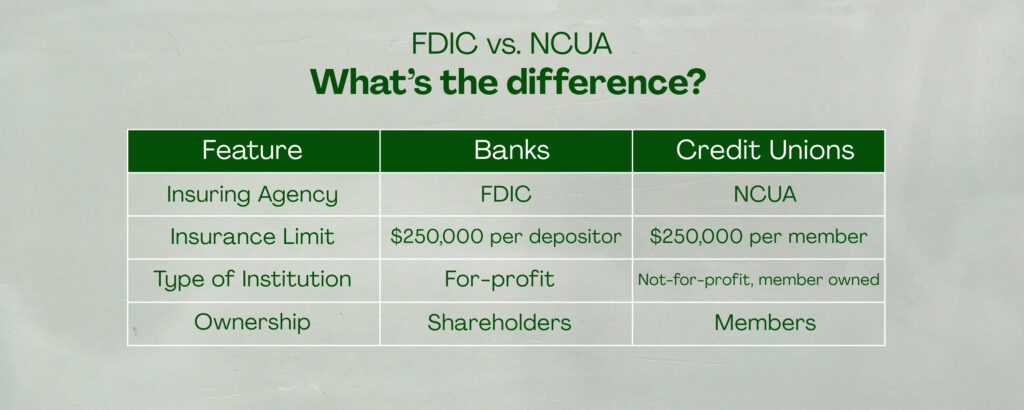

FDIC vs. NCUA: What’s the Difference?

As you can see, the protection is nearly identical. The main difference is who provides the insurance—FDIC for banks, NCUA for credit unions.

Credit Union or Bank: Which One Should You Choose?

The decision between a credit union or a bank often comes down to your personal preferences and financial goals. Here are some key differences:

Why People Choose Credit Unions:

-

Member-owned: When you join a credit union, you become a member—not just a customer.

-

Lower fees: Many credit unions offer lower fees on loans and accounts.

-

Personalized service: Credit unions such as ours often focus on building strong relationships with their members.

-

Local focus: Many credit unions, like Northwoods Credit Union, are deeply rooted in the communities they serve and understand local needs better than large national banks.

Why Some Choose Banks:

-

Wider reach: Big banks may have more branches and ATMs across the country.

-

Advanced tech: Larger banks sometimes offer more advanced digital tools and apps.

-

Broader services: National banks may provide more investment or business banking options.

Is a Credit Union Safe?

Yes—if your credit union is federally insured by the NCUA, your money is just as safe as it would be in a bank. Northwoods Credit Union is federally insured by the NCUA, which means your deposits are protected up to $250,000 per ownership category. You can feel confident knowing your funds are secure with us.

To check if a credit union is NCUA insured, look for the official NCUA logo or visit the NCUA’s Credit Union Locator.

Final Thoughts

So, are credit unions FDIC insured? Technically, no—they’re insured by the NCUA, which offers the same level of protection. Whether you choose a credit union or bank, the most important thing is to make sure your institution is federally insured and meets your financial goals.

If you’re looking for a trusted, community-first financial partner, consider Northwoods Credit Union. We’re proud to offer safe, reliable banking with a personal touch—because at Northwoods, you’re not just a number, you’re a member.